Forex Indicators are to be taken into consideration and are very necessary when it comes to trading the forex market. Every newbie forex trader gets to know this at the initial stage of learning to trade in the forex market because it is one of the fundamentals.

A lot of forex traders utilize these forex indicators to analyze the markets to know their entry points which help them to buy and sell perfectly in the forex market. Forex indicators are a part and parcel of the technical analysis which studies and detects the price action to know where the possibilities are for trades.

And as such, for those who are still confused about how the forex indicators work, this article will help know 10 of them that are very important in forex market analysis. So, in this post, I will show you the top 10 forex indicators that every trader whether new or old needs to know.

What Are Forex Indicators?

Forex Indicators are those elements that are used to examine the forex market data. They study historical data, which include volume and market performance, currency price, etc. Forex indicators lookout for the behavioral patterns of the market in the future and the possibilities of such patterns repeating themselves.

Having known what Forex indicators are, let’s now go into the main forex indicators list every trader and potential traders show have at their fingertips.

Top 10 Forex Indicators

#1 Moving Averages

The idea of moving averages is an essential factor that forex traders should have at their fingertips at every point in time. In the real sense, the forex market is controlled by central banks and multinational companies in the world, so it is pertinent you come to terms with what is going on in the macro realm.

The moving average is one of the forex indicators designed to detect the average price of the previous or the last number of candles that stands for the entire price sentiments.

That means if the price is trading beyond or above the moving average, that points to the fact that buyers are in control of the price.

On the flip side, if the price is trading below the moving average, it entails sellers are in control of the price. And as such, in your trading tactics, you must endeavor to focus on the buy trades if the price trades above the moving average. Hence, the moving averages are one of the most needed forex indicators.

Additionally, the simple moving average shows the average price of the previous number of candles that assists traders to have more understanding of the context of the market. Also, the exponential moving average pays more attention to the newest market movement that gives traders clues for trade entries.

SEE POST: Earn Over $150 Daily Using IPC Bot With 97% Win Rate And 3% Loss

#2 Relative Strength Index

This is another major type of forex indicator that scales all the way from 0 to 100 levels. This particular indicator signifies where the price is mostly expected to reverse.

RSI triggers a signal of a bearish market reversal in an uptrend when the price rises above the 70 levels. Likewise, when the price goes below the 30 levels in a downtrend pattern, it shows a bullish market reversal.

Be that as it may, the Relative Strenght Index makes room for trading moments by forming a divergence with the price.

#3 MACD

Moverage Average Convergence and Divergence (MACD) is one of the most utilized forex indicators in the forex market. MACD is an indicator that comprises of exponential moving average and a histogram. Its main function is to calculate the divergence with the price.

And as such, the normal divergence with MACD and price shows that a market has reversed, while the divergence that has been hidden signifies a continuation of the market.

Moreover, forex traders frequently use MACD as a fundamental or primary indicator to develop a strategy for trading. However, you can as well use this indicator for the purpose of finding a viable marketing reversal spot or a continuation spot. Hence, based on a strategy developed by other MT4 indicators, you can enter trade comfortably.

4 Bollinger Bands

As part of the forex indicators that are very popular amongst professional traders, was developed or created by John Bollinger, hence the name. Bollinger Bands focuses mainly on the moving averages.

In Bollinger Bands, two standard deviations are reflected in the upside and downside, then in the middle a classical moving average. However, in general rating, this indicator serves the easiest purpose to provide a winning trade entry.

The Bollinger Bands’ upper and lower lines operate as potent support and resistance levels. In observation, any rejection noted in these levels triggers a reliable trade entry. Moreso, any breakout that happens in these levels also results in winning trades.

Note also that when a candle closes below or above the middle line establishes a chance of testing the next level.

#5 Stochastic

Stochastic is one of the famous forex indicators known to function as a momentum indicator, which was developed prior to the 1950s. Its main aim is to detect the overbought and oversold zone.

Oftentimes, traders seek to secure a plausible profit-taking spot in their trading approach or master plan. Hence, they take advantage of the stochastic to locate the spot where the price is expected to reverse. This indicator moves from zero level to 100 levels.

That is to say, when price navigates beyond the 70 levels, reversal of price is inevitable. Also, when the price moves below 30 levels the possibility for bullish reversal is created.

RELATED POST: Make Over $11,607 Every Week In Forex Trading With IPC Bot

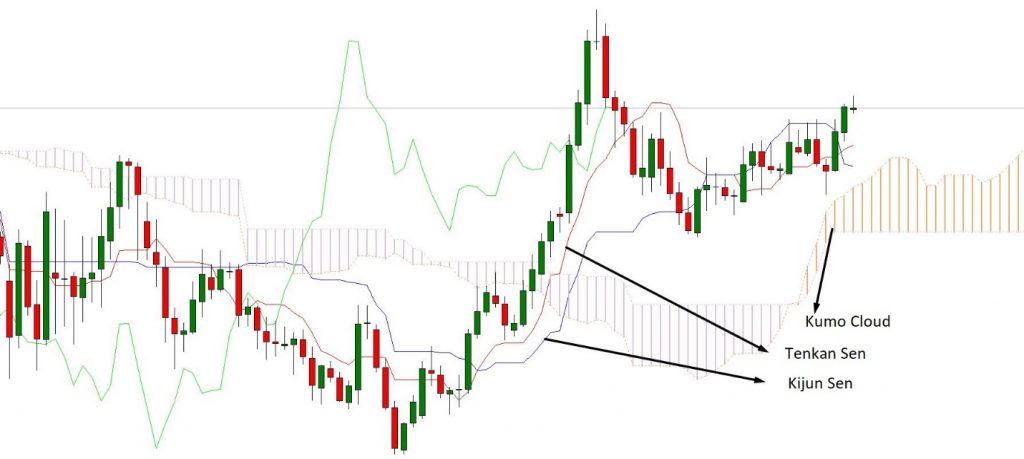

#6 Ichimoku Kinko

As part of the top indicators forex traders use, it is also known as Ichimoku Cloud. This indicator was developed with features to serve as a complete forex trading strategy.

Many features in this indicator assist traders to detect or monitor every side of the market. To be sure, the Kumo Cloud is the first feature of Ichimoku that is utilized to have a proper understanding of the market context.

That means if the price trades below the Kumo Cloud, the entire trend is bearish, and when it trades above the Kumo Cloud it’s a bullish trend.

On the flip side, Tenkan Sen and Kijun are two relevant features or makeup of Ichimoku that assemble with the conception of the moving average. The Tenkan San and Kijun move with the price and any rejection from these two provides an opportunity for trade entry.

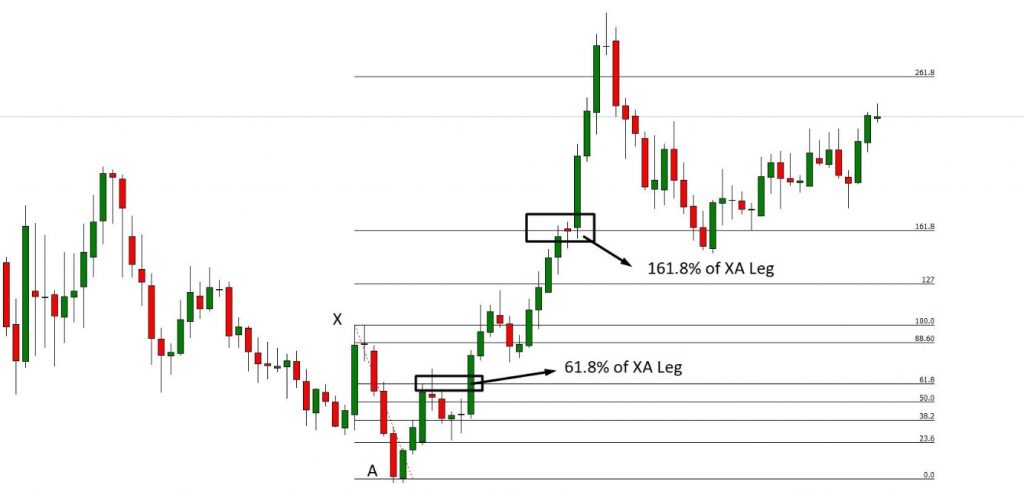

#7 Fibonacci

This indicator is a forex trading tool that indicates the most significant market direction as it is also applicable to creatures on earth.

The most important aspect of Fibonacci is the golden ratio of 1.618. Forex traders utilize this ratio to detect market reversal and the profit-seizing spot in the forex market.

At this point, if the price aligns with the trend, makes good towards 61.8% Fibonacci retracement, and indicates a reversal of the market, the price will hopefully navigate the 161.8% Fibonacci extension level of the present leg.

Moreover, depending on the market patterns and momentum, there are extra levels of Fibonacci such as 23.6%, 38.2%, 50.0%, 88.6%, 127.0%, 261.8%, and so on and so forth.

#8 Average True Range

Average True Range is one of the forex indicators and it is used to detect how volatile a currency pair is. As far as the forex market is concerned, it is very pertinent to measure the volatility because it has to do with the direct movement of the market.

Furthermore, this is also observed in any financial market, that the surge in volatility points to a market reversal, and when volatility decreases, it means the continuation of the market.

On the other hand, the lower Average True Range signals lower volatility, and the higher Average True Range shows higher volatility. That means when the volatility is low, you can increase your take profit. Be that as it may, the lower volatility triggers the possibility of finding reversal trade setups.

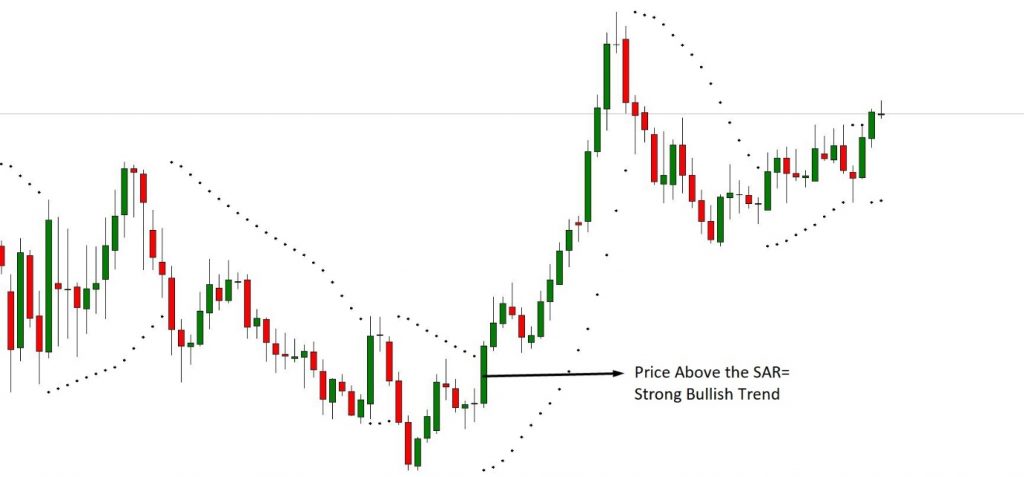

#9 Parabolic SAR

As part of the top forex indicators, traders use, the Parabolic SAR marks out the market trend of a currency pair. This connotes that the overall trend will be bullish if the price is above the Parabolic SAR and vice versa.

Forex traders recognize or pinpoint market trends using the Parabolic SAR. And as such, when the market rejects, Parabolic SAR indicates an opportunity for a trade entry point.

#10 Pivot Point

The function of this forex indicator is to identify the balance supply and demand of a currency pair. If the price gets to the Pivot Point level, it shows the supply and demand of the specific currency pair are the same.

Then if the price navigates beyond the pivot point level, it shows that the demand for a specific currency pair is high. Be that as it may, if the price goes below the pivot point level, that means the supply would be high.

It is noticed often in the financial market that the price is prone to trigger moves at the equilibrium point before indicating a direction. For that reason, Pivot Point anticipates an opportunity to enter trade from the rejection of the pivot point level.

Conclusion

Forex Indicators are significant trading devices that most brokers should come to terms with. In any case, the viability of a specialized trading indicator relies upon how you are using it. Forex traders regularly utilize numerous indicators with various parameters to augment the likelihood of market development or movement.

Sharing Is Caring!